CHARLESTON — Seven Republican senators broke with their party and joined Senate Democrats in opposing Senate Bill 663, a measure aimed at prohibiting large-scale banks from “debanking” individuals or businesses based solely on their lawful exercise of constitutional rights.

The bill was introduced by Sen. Mike Azinger (R-Wood) in response to increasing reports of major banks closing accounts or refusing service to customers over their political views or legal activities, such as purchasing or selling firearms.

Senate Bill 663, which seeks to protect citizens from financial discrimination, specifically targets large banks with assets exceeding $100 billion. The legislation comes amid growing concern that institutions, many of which have previously received taxpayer-funded bailouts, have selectively targeted right-leaning individuals and groups, including high-profile figures such as Melania Trump, Barron Trump, conservative non-profits, and several firearm retailers with Federal Firearms Licenses (FFLs) in good standing.

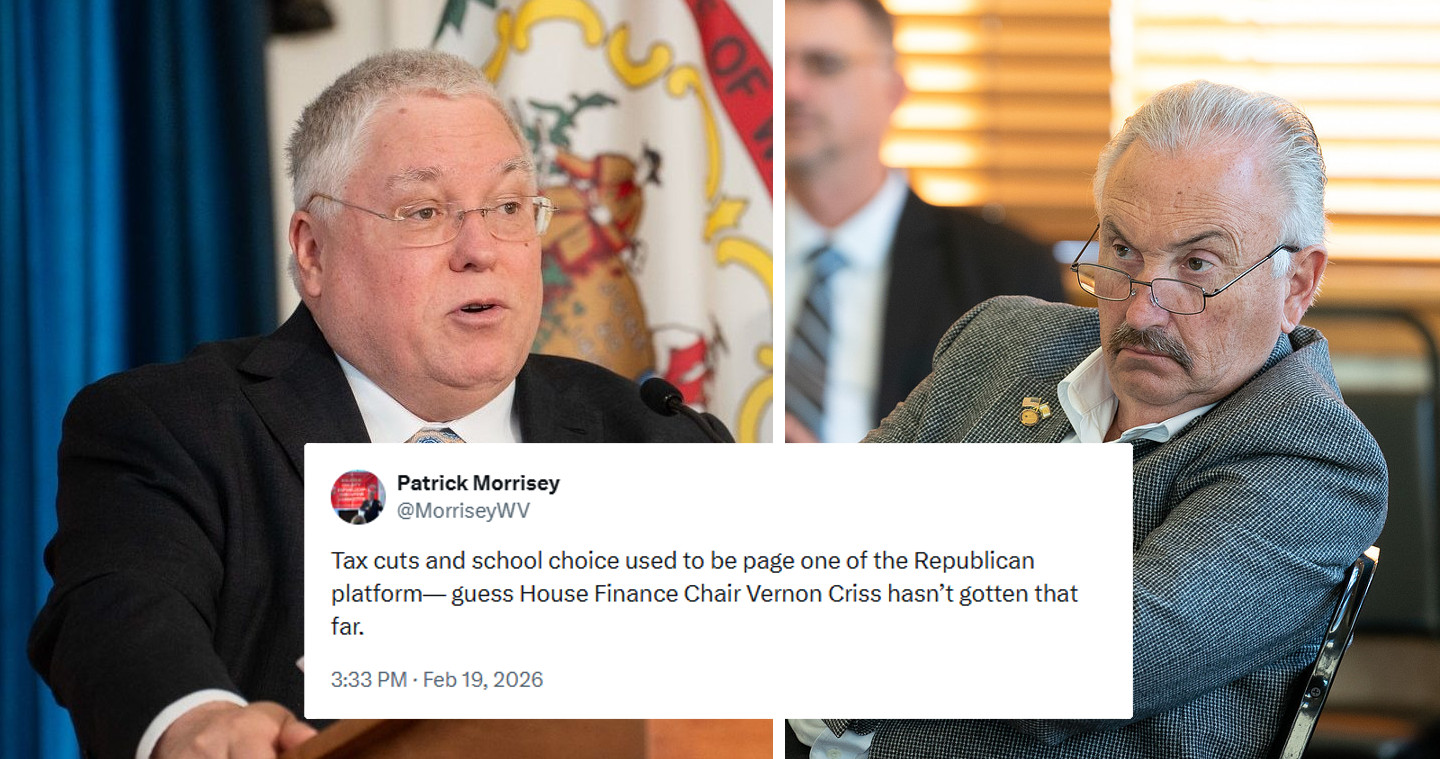

One of the primary opponents of the bill, Sen. Eric J. Tarr (R-Putnam), argued that its passage could deter large banks from setting up operations in West Virginia. Tarr, who has received significant backing from the banking sector, emphasized the importance of fostering a competitive financial environment and protecting the interests of large financial institutions.

Sen. Eric Tarr, R-Putnam, voiced his opposition to Senate Bill 663, arguing that the bill would create an “onerous cause of action” for multi-billion-dollar banks in West Virginia.

“I just want to rise in opposition to this bill,” Sen. Tarr continued. “It significantly places an onerous cause of action on the employers in our state, namely the banks in our state.”

He warned that large businesses considering West Virginia as a potential location could be discouraged by the risk of legal actions.

“Businesses that locate their $100 billion businesses … they pay attention to how many causes of action a state has on their books,” Tarr said. “Are the businesses that … may have considered West Virginia, but for the number of causes of actions we have on our books, they realize they are not welcome here … because if they plant their investment here, they are going to be sued.”

Tarr further argued that large banks would be deterred by potential increases in insurance risks and damage to their reputation, which could even affect stock prices.

“That means their insurance risk goes up. That means the notoriety, fame, or defame of their business goes up or down. It also means that it could affect stock prices on publicly traded entities, which is where the really, really, really big risk is when you bring in companies of this level … and you’re going to say … ‘You know what, if you make enough money, you’re an easy target for us. We’re going to sue you.'”

He concluded by asserting that the bill would harm West Virginia’s economy and job market.

“This is bad for West Virginia, because it runs jobs out of West Virginia. I urge rejection of this bill.”

By supporting large financial institutions over $100 billion, Sen. Tarr joined Senate Democrats in encouraging these banking corporations to establish themselves in West Virginia, though they often provide low-wage paying jobs with limited career advancement to employees that do not support or meet their DEI criteria, often preferring to hire out-of-state workers from blue states and relocating them to their West Virginia branches.

Tarr was joined by his co-senator, Sen. Amy Nichole Grady (R-Mason), in opposing the legislation. Both senators have faced criticism from conservative-leaning constituents who argue that they are prioritizing the interests of large banks over the protection of individual rights.

Supporters of SB 663, however, have argued that the bill is necessary to safeguard the ability of conservatives and other law-abiding citizens to access essential financial services without fear of discrimination. Advocates assert that recent incidents of debanking — in which financial institutions have closed accounts or denied services based on customers’ political opinions, legal firearm purchases, or affiliations — have created a chilling effect on free expression.

Seven Republican senators, including: Sen. Eric Tarr (R-4), Sen. Amy Nichole Grady (R-4), Sen. Ryan Weld (R-1), Sen. Jack David Woodrum (R-10), Sen. Tom Takubo (R-17), Sen. Vince Deeds (R-10), and Sen. Charlie Clements (R-2), joined all Senate Democrats in opposing Senate Bill 663. This has sparked sharp criticism from proponents of the bill.

Critics argue that by siding with large financial institutions over the protection of individual rights, these lawmakers have prioritized the interests of big banks over the needs of their constituents. This legislation, which seeks to prevent large-scale banks from discriminating against individuals based on their lawful political or legal activities, would shield many Republican-leaning individuals and businesses from being ‘debanked’ for their beliefs. This unexpected alliance between Republican senators and Senate Democrats signals a deeper divide, with some critics suggesting that these lawmakers’ allegiance to corporate interests undermines their support for the rights and freedoms of the people they represent.

Senate Bill 663 specifically targeted banks with assets exceeding $100 billion, excluding smaller community banks that are prevalent in West Virginia.

Large institutions have demonstrated a recent history engage in discriminatory practices that affect the Republican base and other law-abiding citizens, but the legislation would have no impact on smaller, locally focused banks. West Virginia’s banking environment is already competitive but still profitable for smaller banks, which would not be affected by the bill.

By opposing it, these Republican senators have signaled their support for attracting larger, predatory banks to the state—banks that often buy up smaller institutions, creating monopolies that limit consumers’ banking choices. This could leave West Virginians with fewer options and no safe alternative to place their money outside of financial institutions that could engage in practices harmful to their values or interests.

The debate over SB 663 highlights a growing divide between those who prioritize the interests of large corporations and those who advocate for individual freedoms and protections against financial discrimination.

03-31-0248