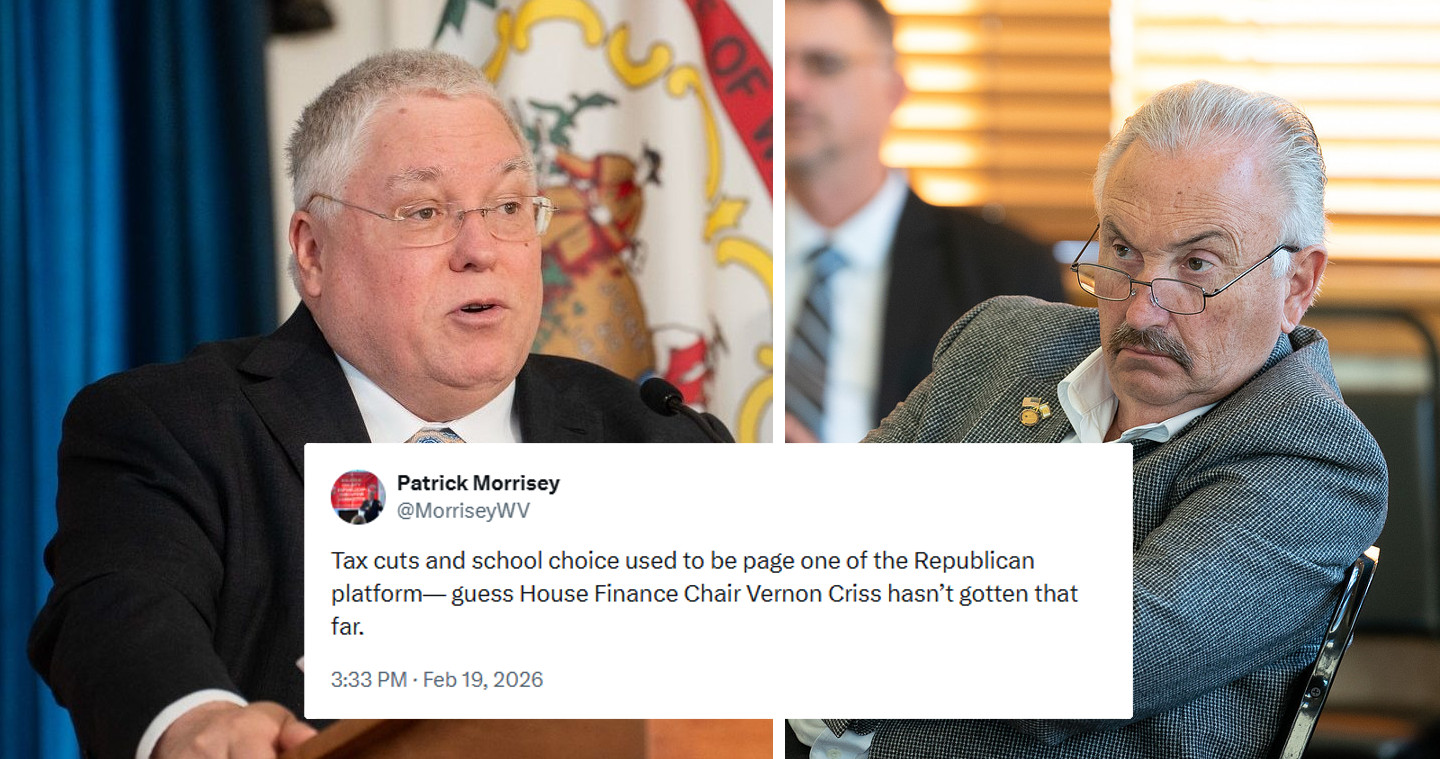

WASHINGTON — The Internal Revenue Service has filed notices of a federal tax lien against U.S. Sen. Jim Justice of West Virginia, marking the latest in a series of financial troubles tied to the former governor, his family and their business network, according to a report by POLITICO.

Documents obtained by POLITICO list Justice and his wife, Cathy, as owing “a total balance of more than $8 million in unpaid assessments.” The filings represent the first known instance of the IRS taking direct action against Justice personally, according to public records in Greenbrier County that date back several decades.

It is unclear why the IRS chose to move forward with the lien now. POLITICO reported that the agency filed two documents—both prepared and signed Sept. 30 and stamped Oct. 2 by a Greenbrier County clerk.

According to the IRS, the agency typically has 10 years from the date a tax is assessed to collect payment. One of the assessments in Justice’s case is dated Nov. 25, 2015, placing the agency near the end of its collection window, POLITICO noted.

The tax periods listed in the lien documents include 2009, 2017 and 2022. The 2009 period predates Justice’s time as governor, while all of them precede his 2024 campaign for the U.S. Senate.

Justice, a Republican and strong supporter of former President Donald Trump, took office in January after winning the seat previously held by Sen. Joe Manchin, a longtime Democrat who later became an Independent.

Neither the IRS nor Justice’s office immediately responded to requests for comment.