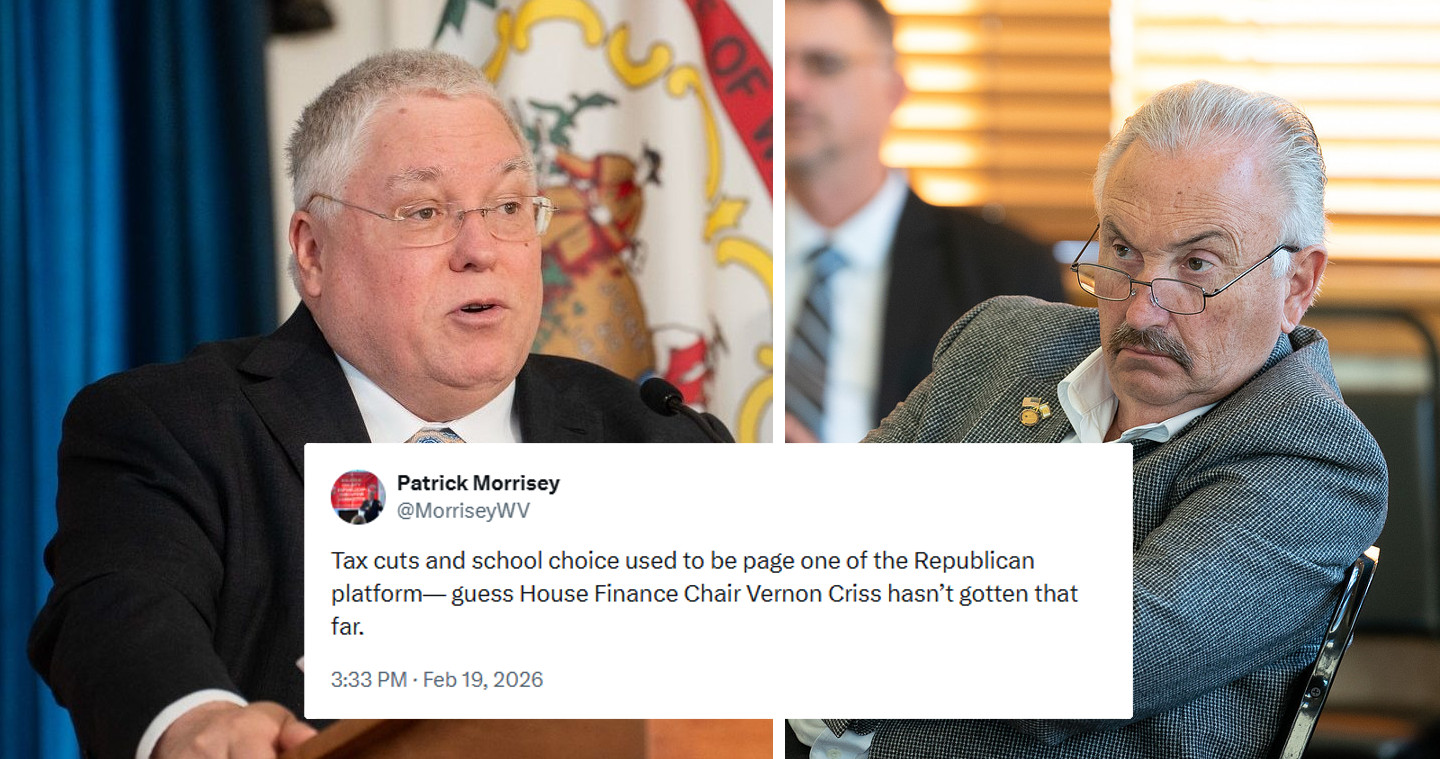

CHARLESTON, WV — On Wednesday, the House of Delegates passed a massive tax hike, which is being referred to as the biggest tax increase in West Virginia history.

The budget proposes several 0 to 6 percent increases on various services, and was approved by a vote of 58-42.

In West Virginia, less than half of the population is employed. People are leaving at a higher rate than nearly every other state. According to AFP, more than two-thirds of people who have left the Mountain State did so for job opportunities. Noting these realities, some fear that the additional tax hikes could worsen such problems.

These hikes include the following:

- 6 percent on telecommunications.

- 6 percent on direct transportation.

- 6 percent tax on personal care: barbers, nail pedicurists, all non-medical.

- 6 percent tax on contractor services for the first $40,000.

- 6 percent tax on health clubs and fitness.

Many worry that the additional tax on contractors will discourage construction and building growth. Overall, it is believed that these increases will empty West Virginia taxpayers’ pockets, and be detrimental to state economy.