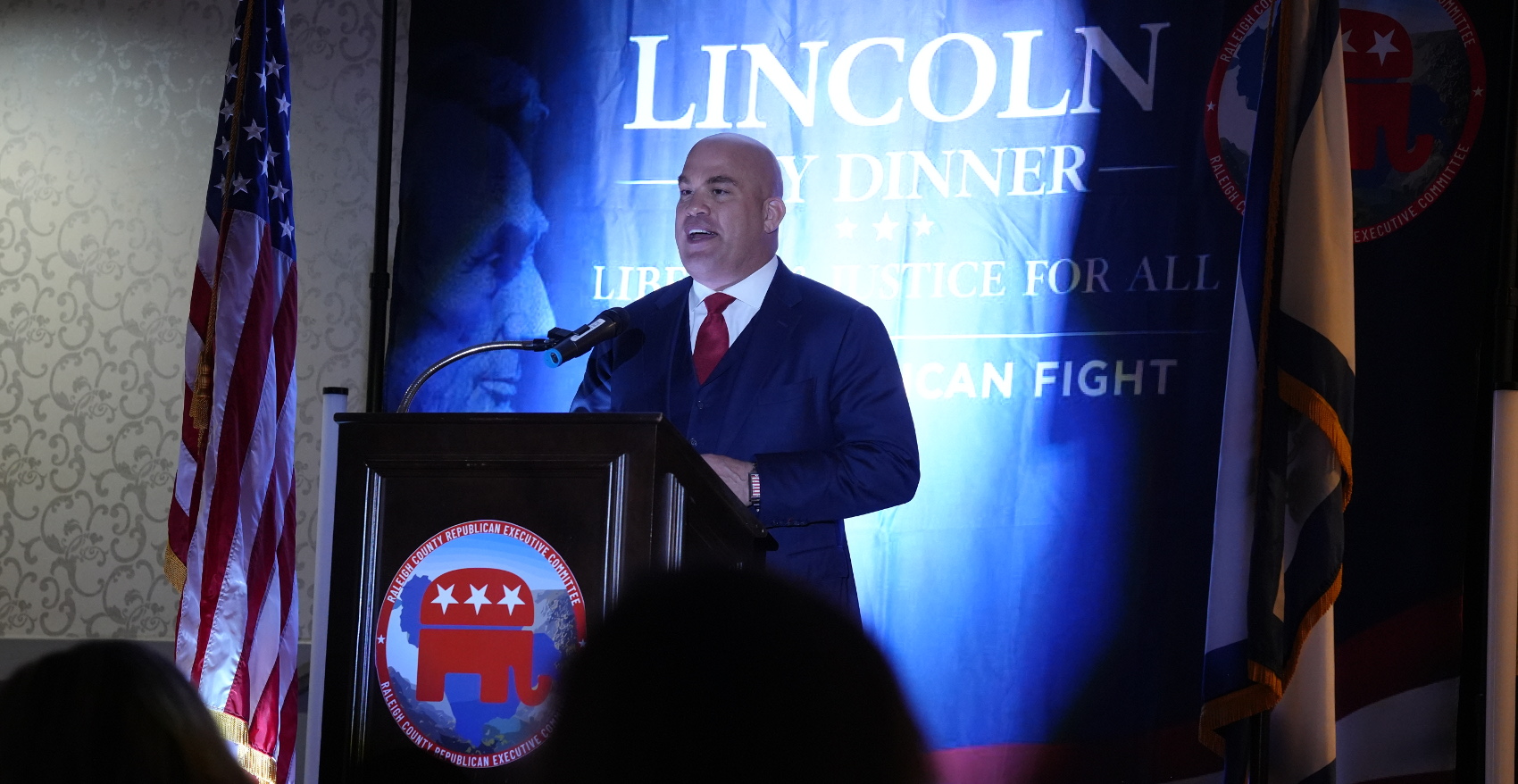

Recently, a political action committee called West Virginia Patriots for Liberty distributed mailers against Sen. Robert Karnes (R-11) for supporting S.B. 335.

The mailers used innuendo, inferring that S.B. 335 was a massive tax hike. The Senate Bill was a tax reform overhaul that would have eliminated the individual income tax, the corporate income tax, and the current sales tax. It would have replaced it with a consumption tax of 8 percent, saving West Virginians thousands of dollars in the long run.

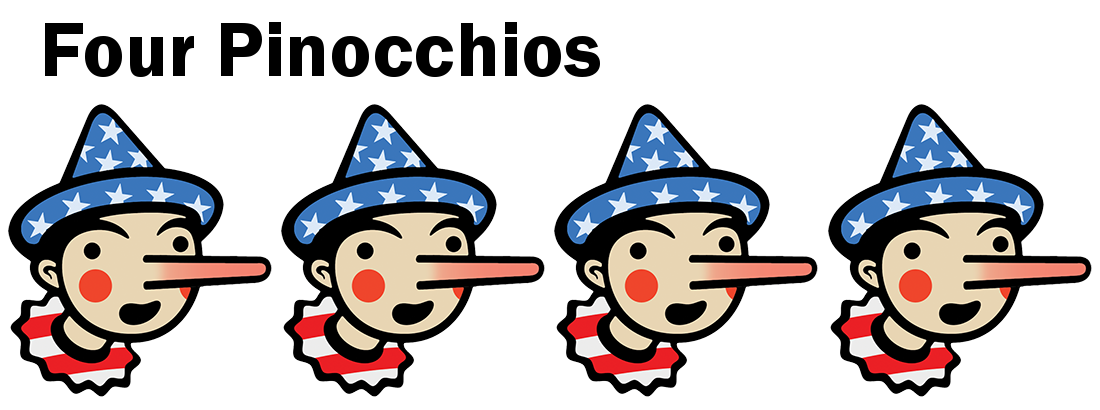

Mountaineer Journal has given this mailer four Pinocchios for being intentionally deceiving, and completely misrepresenting a bill for political advantage. These mailers portrayed S.B. 335 as being a new tax, costing “$1.3 billion in new taxes.” This attempted to portray the legislation as being a new tax rather than a replacement.

The mailers also claimed that this bill would cause West Virginia to have the “highest sales tax in the nation.” This is completely false, understanding that this tax establishes a consumption tax, rather than a sales tax. The two are similar, but not the same.

According to the Tax Foundation, “A consumption tax, like the current general sales tax or the proposed revised sales tax, represents a more neutral and economically productive approach to taxation overall. Taxes on capital accumulation or labor force participation have larger ramifications for the broader economy. S.B. 335 represents a bold plan to jump-start West Virginia’s economy. ”